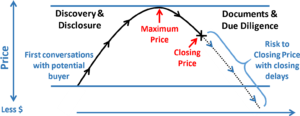

All negotiations concerning the sale price of a business should be expected to travel on what I call the “Selling Price Curve.”

Discovery & Disclosure

On the upslope of the Discovery & Disclosure side, your potential sales price advances up the Selling Price Curve. This is due to you creating the largest value for your business in the mind of your buyer. You paint the prettiest, rosiest, most beautiful, while still accurate, picture you can. With each stage of the discussion, and each business disclosure, you show and create value for the buyer. Your selling price goes up the Selling Price Curve accordingly. You keep selling, impressing, and building your momentum and increasing your value.

Documents & Due Diligence

On the Documents and Due Diligence side of the Selling Price Curve, several categories of activities occur. These categories have the potential to bring that selling price you worked hard to raise right back down. After the Letter of Intent is signed, the seller’s and buyer’s attorneys draft and negotiate legal definitions and documents. These become the final rules governing the payment of the selling price and the parties’ relationship after closing. At the same time, the buyer’s attorneys and employees conduct legal and operational due diligence.

Document Drafting When Selling Your Business

During the drafting of the documents, a great number of nuances are discovered. These nuances are then negotiated and described in binding fashion. The devil is truly in the details. Payment terms and conditions, representations of facts, and the consequences of inaccuracies all effect of reducing your purchase price. These details are often in the form of indemnities requiring post-closing payments by you back to the buyer,

What can be done? Bringing in the right attorney, one who knows this process, and bringing them in early is key. Attorneys review key employee contracts for the right non-compete language and must be done before signing a non-disclosure agreement.

Why that early? You need to see lots of deals go right and even more go wrong to help a seller avoid all the pitfalls. It helps capture all the opportunities when selling your business. The right business transaction attorney helps you best position good news and effectively minimize the impact of bad news. The right attorney will help you build your maximum price during the Discovery & Disclosure phase in a way that will be harder to peel back after the LOI is signed. It might result in a lower LOI price, but a higher price at closing – and that’s the price you care about.

If you have any further questions about this, feel free to reach out to us anytime.